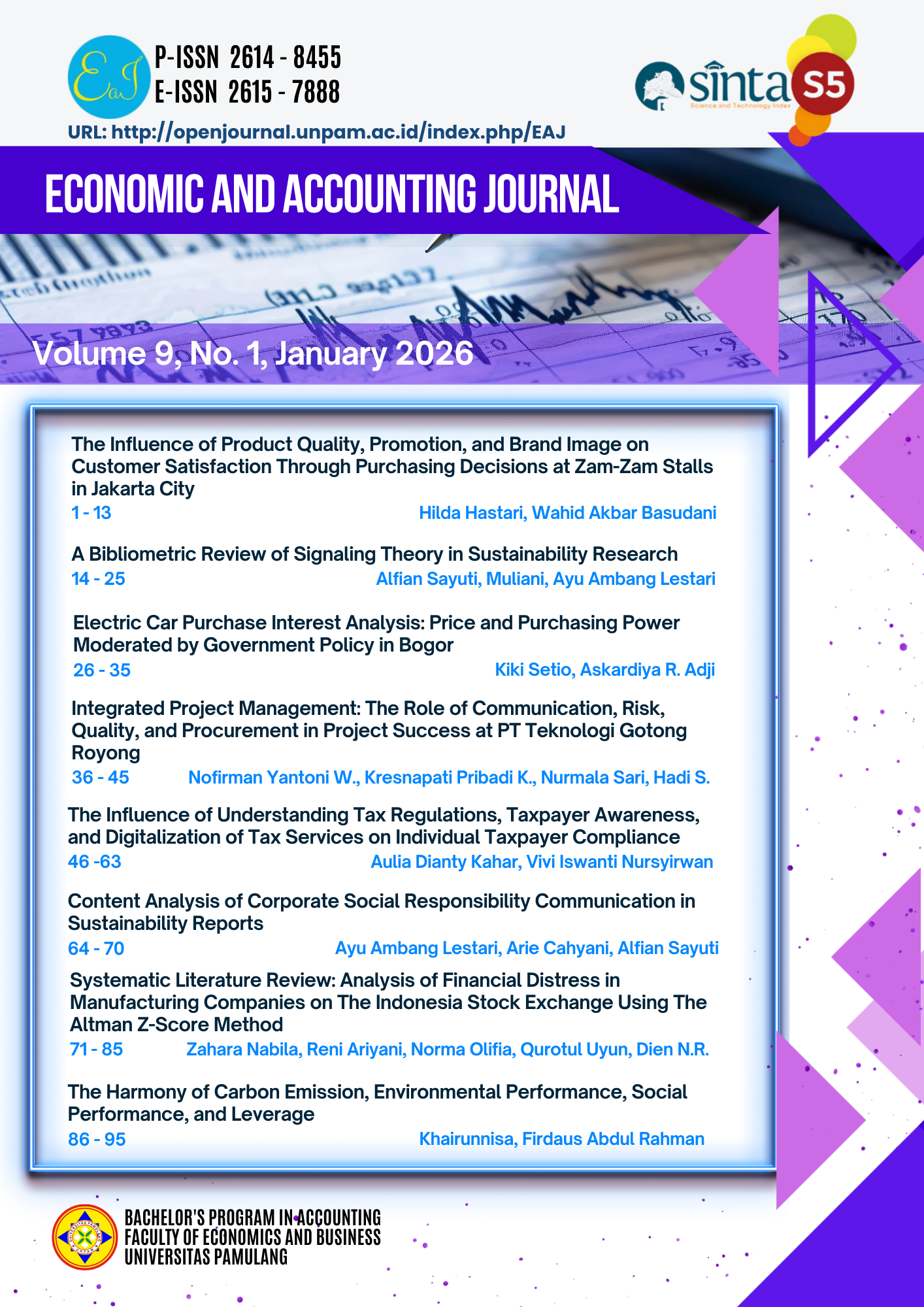

The Influence of Understanding Tax Regulations, Taxpayer Awareness, and Digitalization of Tax Services on Individual Taxpayer Compliance

DOI:

https://doi.org/10.32493/eaj.v9i1.y2026.p46-63Keywords:

Regulation, Awareness, Digitalization, Tax ComplianceAbstract

Respondents in this research were accounting students majoring in taxation at the Faculty of Economics and Business, Pamulang University. They were selected because they have received formal education related to taxation and are considered to possess adequate foundational knowledge to understand tax obligations. Primary data were collected using a structured questionnaire distributed to participants who met the sampling criteria. The purposive sampling technique was applied, resulting in a total sample size of 237 respondents. The variables used in this study consist of Understanding of Tax Regulations (X1), Taxpayer Awareness (X2), and Digitalization of Tax Services (X3) as independent variables, while Individual Taxpayer Compliance (Y) serves as the dependent variable. Before conducting hypothesis testing, the research instrument underwent validity and reliability assessments to ensure that all indicators were appropriate and consistent. The results confirmed that the instrument met the required standards, indicating that it was suitable for further analysis. The findings of this study show that Understanding of Tax Regulations has a positive and significant effect on Individual Taxpayer Compliance. This suggests that individuals with better knowledge of tax rules are more capable of fulfilling their obligations correctly. Taxpayer Awareness also demonstrates a positive and significant influence, indicating that individuals who understand the importance of taxes tend to comply more willingly. Furthermore, the Digitalization of Tax Services contributes positively by simplifying administrative processes and increasing accessibility. Overall, all three variables significantly enhance taxpayer compliance.

References

Ajzen, I. (1991). Social cognitive theory of self-regulation. Organizational Behavior and Human Decision Processes, 50(2), 248–287. https://doi.org/10.1016/0749-5978(91)90022-L

Amelia, L., & Nursyirwan, V. I. (2024). Pengaruh Machiavellian, Crime Perception, Status Sosial Ekonomi dan Sanksi Pajak terhadap Persepsi Penggelapan Pajak. Jurnal Akuntansi, Manajemen, dan Perencanaan Kebijakan, 2(1), 12. https://doi.org/10.47134/jampk.v2i1.428

Anggarini, L. P. I., Yuesti, A., & Sudiartana, I. M. (2019). Pengaruh Penerapan Kebijakan Tax Amnesty, Pengetahuan Perpajakan, Kesadaran Wajib Pajak, Dan Sanksi Perpajakan Terhadap Kepatuhan Wajib Pajak Orang Pribadi Di Kantor Pelayanan Pajak Pratama Denpasar Timur. Jurnal Riset Akuntansi, 9(1), 48–61.

Arina Nurul Hidayah, & Indriyana Puspitosari. (2024). Memahami Perilaku Kepatuhan Pajak Dengan Persepsi Teori Atribusi. JIEF Journal of Islamic Economics and Finance, 4(1), 41–61. https://doi.org/10.28918/jief.v4i1.7286

Bahri, N. A., Khairunnisa, W., Dwihatmoko, M. Z., & Gumelar, T. M. (2022). Studi Komparasi Kepatuhan Membayar Pajak Bumi dan Bangunan Antara Kecamatan Ciambar dan Kecamatan Nagrak Dalam Perspektif Theory of Planned Behavior. Sanskara Akuntansi dan Keuangan, 1(01), 1–11. https://sj.eastasouth-institute.com/index.php/sak/article/view/12

Biduri, S., Hariyanto, W., Maryanti, E., Nurasik, N., & Sartika, S. (2022). the Perspektif Theory of Planned Behavior Terhadap Intensi Pns Untuk Melakukan Whistleblowing. Media Mahardhika, 20(2), 331–341. https://doi.org/10.29062/mahardika.v20i2.352

Darmawan, K. A. (2023). Kacung Alim Darmawan (2023) Judul: Peran Pelayanan Digitalisasi Pajak Terhadap Kepatuhan Wajib Pajak Orang Pribadi Dengan Pemahaman Penggunaan Teknologi Sebagai Variabel Moderasi. Aleph, 87(1,2), 149–200. 8

Davis, F. D. (1989). Perceived Usefulness, Perceived Ease of Use, and User Acceptance of Information Technology. www.jstor.org. https://www.jstor.org/stable/249008?read-now=1&seq=1#page_scan_tab_contents

Gloriabarus. (2023). Fenomena Perpajakan di Indonesia: Sentimen terhadap Pajak Positif tapi Kepatuhan Membayar Pajak Rendah. ugm.ac.id. https://ugm.ac.id/id/berita/23411-fenomena-perpajakan-di-indonesia-sentimen-terhadap-pajak-positif-tapi-kepatuhan-membayar-pajak-rendah/

Gumelar, T. M., & Shauki, E. R. (2020). Pencegahan Fraud Pada Pengelolaan Dana Organisasi: Perspektif Theory of Planed Behavior. Jurnal ASET (Akuntansi Riset), 12(1), 176–200. https://doi.org/10.17509/jaset.v12i1.23963

Hasanah, U., Rusydi, M., Maulana, C. Z., Maftukhatushalikhah, M., & Azwari, P. C. (2021). Penggunaan Digital Payment Syariah Pada Masyarakat Di Kota Palembang: Pendekatan Teori Technology Acceptance Model (TAM) pada Layanan Syariah LinkAja. Jurnal Intelektualita: Keislaman, Sosial dan Sains, 10(1), 93–107. https://doi.org/10.19109/intelektualita.v10i1.8410

Kemenkeu. (2024). Kementrian Keuangan RI DIREKTORAT JENDRAL PERBENDAHARAAN. Educacao e Sociedade, 1(1), 1689–1699. http://www.biblioteca.pucminas.br/teses/Educacao_PereiraAS_1.pdf%0Ahttp://www.anpocs.org.br/portal/publicacoes/rbcs_00_11/rbcs11_01.htm%0Ahttp://repositorio.ipea.gov.br/bitstream/11058/7845/1/td_2306.pdf%0Ahttps://direitoufma2010.files.wordpress.com/2010/03/emi

KEMENKEU. (2023). Kementrian Keuangan RI. Kementrian Keuangan RI DIREKTORAT JENDRAL PERBENDAHARAAN, 1. https://djpb.kemenkeu.go.id/kppn/lubuksikaping/id/data-publikasi/artikel/3134-kontribusi-umkm-dalam-perekonomianindonesia.html

Nasiroh, D., & Afiqoh, N. W. (2023). Pengaruh Pengetahuan Perpajakan, Kesadaran Perpajakan, Dan Sanksi Perpajakan Terhadap Kepatuhan Wajib Pajak Orang Pribadi. RISTANSI: Riset Akuntansi, 3(2), 152–164. https://doi.org/10.32815/ristansi.v3i2.1232

Nursyirwan, V. I., & Ardaninggar, S. S. (2020). the Factor Analysis That Influence the Student Purchase Intention in Shopee E-Commerce. EAJ (Economic and Accounting Journal), 3(2), 118–129. https://doi.org/10.32493/eaj.v3i2.y2020.p118-129

Pardede, R. K. B. (2023). Kasus Rafael Dapat Berimbas pada Penurunan Kepatuhan Membayar Pajak. www.kompas.id. https://www.kompas.id/baca/ekonomi/2023/03/02/kasus-rafael-dapat-berimbas-kepada-penurunan-kepatuhan-masyarakat-bayar-pajak

Pradnyawati, A. A. D. (2024). Pengaruh Kesadaran Wajib Pajak, Pengetahuan Dan Pemahaman Pajak, Pelayanan Fiskus, Sanksi Perpajakan, Dan Tarif Pajak Terhadap Kepatuhan Wajib Pajakorang Pribadi Di Kantor Pelayanan Pajak Pratama Denpasar Timur. Tesis Universitas Mahasaraswati Denpasar, 1–31.

Prassadewi, Z. A. (2019). Pajak Itu Dari Rakyat, Oleh Rakyat, dan Untuk Rakyat. www.kompasiana.com. https://www.kompasiana.com/zhahwandaap/5e92a63d097f3639cf50d0c2/pajak-itu-dari-rakyat-oleh-rakyat-dan-untuk-rakyat

Putra, D. A. (2024). Di Balik Rendahnya Kepatuhan Wajib Pajak Lapor SPT Tahunan. tirto.id. https://tirto.id/di-balik-rendahnya-kepatuhan-wajib-pajak-lapor-spt-tahunan-gW94

rumahpajak.web.id. (2025). Mewujudkan Keadilan Lewat Pajak: Penerapan PTKP di Indonesia. rumahpajak.web.id. https://rumahpajak.web.id/2025/06/22/mewujudkan-keadilan-lewat-pajak-penerapan-ptkp-di-indonesia/

Tiara Sari, & Ani Siska MY. (2023). Pengaruh Pengetahuan Terhadap Kepatuhan Wajib Pajak Orang Pribadi Di Dki Jakarta. Seminar Nasional Pariwisata dan Kewirausahaan (SNPK), 2, 580–584. https://doi.org/10.36441/snpk.vol2.2023.172

Widagsono, S. (2017). Pengaruh Pengetahuan Perpajakan, Sanksi, dan Religiusitas Terhadap Kepatuhan Wajib Pajak (Studi Kasus Pada KPP Pratama Kepanjen). Skripsi, 1–94.

Additional Files

Published

Issue

Section

License

Copyright (c) 2026 Aulia Dianty Kahar, Vivi Iswanti Nursyirwan

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.

Authors who publish with this journal agree to the following terms:

- Authors retain copyright and grant the journal right of first publication with the work simultaneously licensed under a Creative Commons Attribution License that allows others to share the work with an acknowledgement of the work's authorship and initial publication in this journal.

- Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the journal's published version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgement of its initial publication in this journal.

- Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See The Effect of Open Access).

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.